Froddy

Member

- Messages

- 1,072

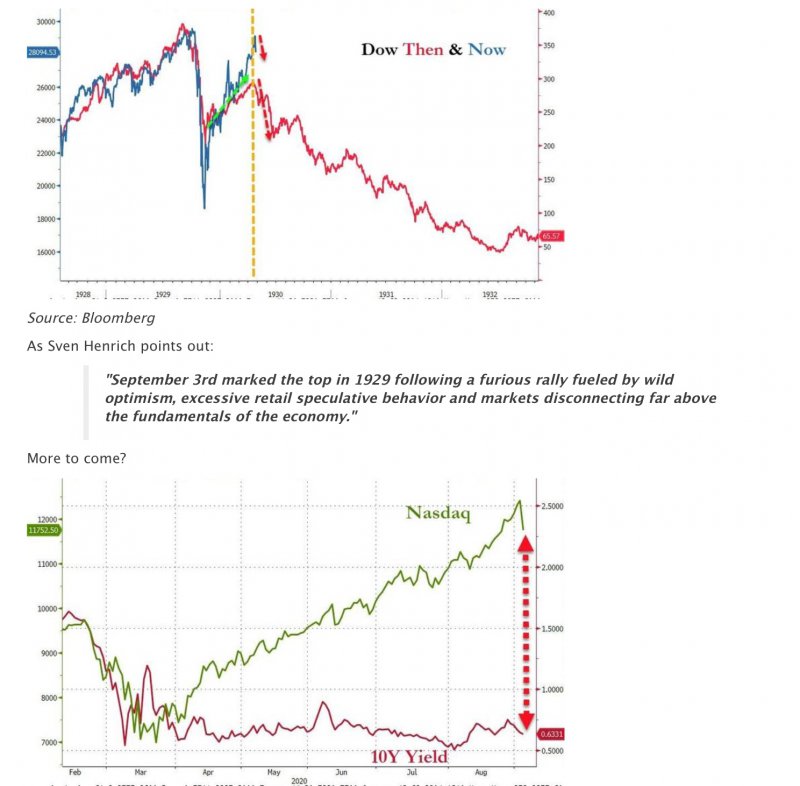

It's just a matter of time, and I don't think it will be long.

Here's a fun fact for you (monthly chart of the Nasdaq):

Here's a fun fact for you (monthly chart of the Nasdaq):

While the economy went the opposite way.........fed money.It's just a matter of time, and I don't think it will be long.

Here's a fun fact for you (monthly chart of the Nasdaq):

What do u reckon Froddy, oh knowledgeable chartman do you think we’re in for a bang?If anybody is trading crude (WTI), keep an eye on this 4 hour chart ...

It certainly will! Is this profit-taking, or do they mean business?Finally a bit of reality- it will be interesting to see how this plays out.

You’re speaking to the converted.

Thanks for sharing - I enjoyed listening to that ...

One other thing to point out is that if gold/silver ever hit these levels the economic carnage that would have ensued at even $5000 or £250 would be catastrophic for many.Thanks for sharing - I enjoyed listening to that ...

A word of caution, however. In the interview he discusses the technical indicators which he uses, including the RSI (relative strength index) and he also talks about the principle of "reversion to the mean".

What he doesn't tell you is that the RSI for DXY (the dollar index) is technically oversold (and now pointing back up) on the weekly chart, and that DXY is at the extremes of the Keltner Channels which act as "railway tracks" for price. At 23:20 he says that price typically reverts to the mean and then shoots to the opposite side.

We can see this in 2018 (to the left of the chart) - I've circled the RSI then and today, and you can see how price behaved from there the last time the reading was this low. NOT saying it will be a repeat, but it can't be ignored.

Looking at his analysis and using his methodology on the weekly chart above, you'd be brave to sell the dollar right now - not before it has re-tested, and failed at, the mean (the red line).

It's really about timing, although I didn't understand him to be suggesting that the dollar will collapse tomorrow (as opposed to weeks or months from now) ...

I've been watching BXY (GBP index closely) and it's at "exhaustion risk" on the weekly chart, being at the top of the broadening formation.GBP- be warned, its now under huge pressure after Johnsons Brexit deadline. Swap out to USD and convert back as it tanks. Just about every EU negotiation has gone down to the wire. My gut tells me this will be no different and I feel its unlikely that a deal will be reached at all.

https://www.zerohedge.com/medical/a...d-vaccine-study-put-hold-due-adverse-reactionRumours abound that the Oz Govt has signed a multi million deal with Astra Zeneca securing "vaccine" if one is developed.

How will its share price react?

Yup, the whale has gone leaving no liquidity.Yes, it's getting interesting!

Tomorrow will be telling; what has really struck me today is that there is no sense of panic in the selling - it's all very calm, and the VIX is not behaving as I would have expected - it feels slightly odd. The markets didn't bounce at all into the close, and the S&P didn't defend the 8EMA on the weekly chart (although we have 3 days left for it to do so):

Have we simply run out of buyers?? That's what the put:call ratio has been telling us for some time now ...