I

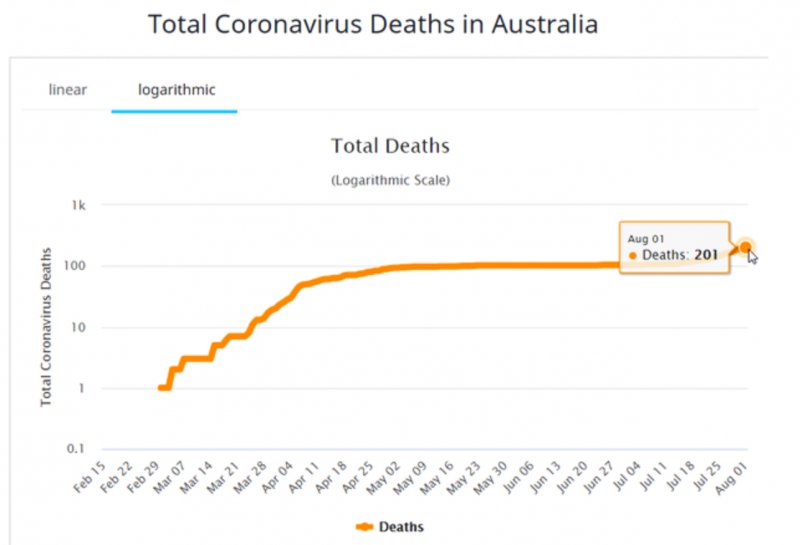

I don’t think you’ve missed the boat at all with the Miners. Money debasement is here to stay along unfortunately with Covid and gold/silver should continue to rise as a result.

Another positive sign for the sector rising further is that Robinhood investors are now beginning to take note.

View attachment 73742

Here’s a strategy to follow.

Divide your cash sum by 6 and invest the amount into the Blacktock fund each month for the next 6 months. This will average the price that you buy in at.

Sam, I’ve a huge fondness for Scottish Widows (not women who have lost their hubbies before someone says something) as I started my career there, 10 excellent years, but have to say that their pension fund choices are pants.

Are you in a position where you could consider a Sipp as an option. Far more sophisticated regards investment choices, with far better growth potential.