Wattie

Member

- Messages

- 8,640

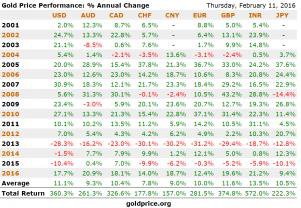

Some of you may have noticed that this Central Banker manipulated global economy is beginning to fall apart.......it's headed worse than 2007/2008.

If any of you would like to buy some financial insurance against bankers stupidity "mates rates" are available on the oldest store of value that exists......up 14.4% so far this year in GBP and headed a lot higher.

Become your own central bank, do what they do, not what they say!

www.buying-bullion.com

Drop me a line on sales and I'll sort you out.

Cheers Wattie

If any of you would like to buy some financial insurance against bankers stupidity "mates rates" are available on the oldest store of value that exists......up 14.4% so far this year in GBP and headed a lot higher.

Become your own central bank, do what they do, not what they say!

www.buying-bullion.com

Drop me a line on sales and I'll sort you out.

Cheers Wattie