I’m inclined to agree about the value of hard assets..... but then again, every classic boom in history has been followed by a crash.. I feel you can’t fight history. Albeit long term, the booms always ride out the crashes eventually. Far better anyway, to just buy what you enjoy, and if you gain financially, (or even gain back a tiny bit of your usually epic restoration/ running costs, then happy days).

But the classic car market is very generational anyway. 80s / 90s stuff currently in vogue and booming due to ‘us lot’ getting to monied age now.... I’m guessing (but haven’t checked) that it’s not the same for the likes of MGBs and Stags, now their fans are moving on from this world... How many of us lot want an MGB or an Austin 7? How many millennials will want a XR3 in their turn?

I think that there is a certain fetishization to history, and the fashions that circulate around it, and this will move forwards. Take the Goodwood Revival – look how popular that is with all age groups. You can expect similar going forward for 70s/80s/90s cars – that's inevitable, it just needs the cahojnes and capital to make it happen; look at the success of RADwood in the USA. Remember that millenials are a large spread – technically I'm one, and I'm 39. Mind you I can remember when 'downloading p0rn' meant fishing discarded copies of Razzle out of hedges near truck stops.

I think there will be the occasional deflation here and there, or a correction to the inflationary curve, perhaps, but an 80s-style bust? No, because there's far more money (real or otherwise) floating around, plus new markets like the far east, Asia and Africa, perhaps South America too. The American appetite for stuff like Escort Cosworths and BMW M3s is quite something too.

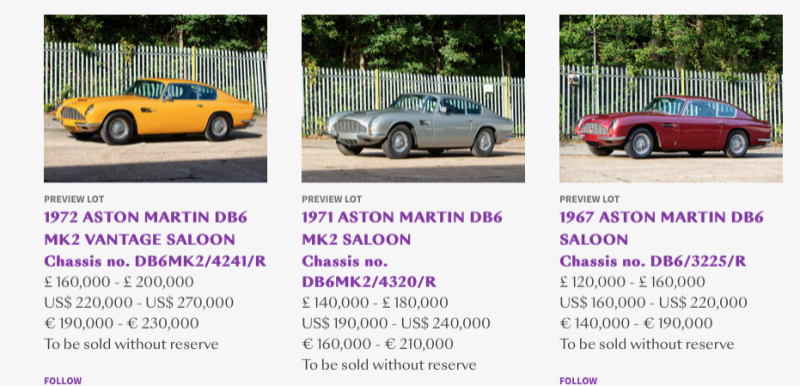

The biggest risk is marque fire sales, particularly for models that aren't that rare. See the attached picture – that's three DB6s in one sale that isn't Aston-centric.